There Must Be Some Way Out of Here: Commissioner Hester Peirce Calls for Public Input on Digital Asset Regulation

Breaking the Stalemate: Commissioner Hester Peirce Seeks Public Insight on Crypto Regulation

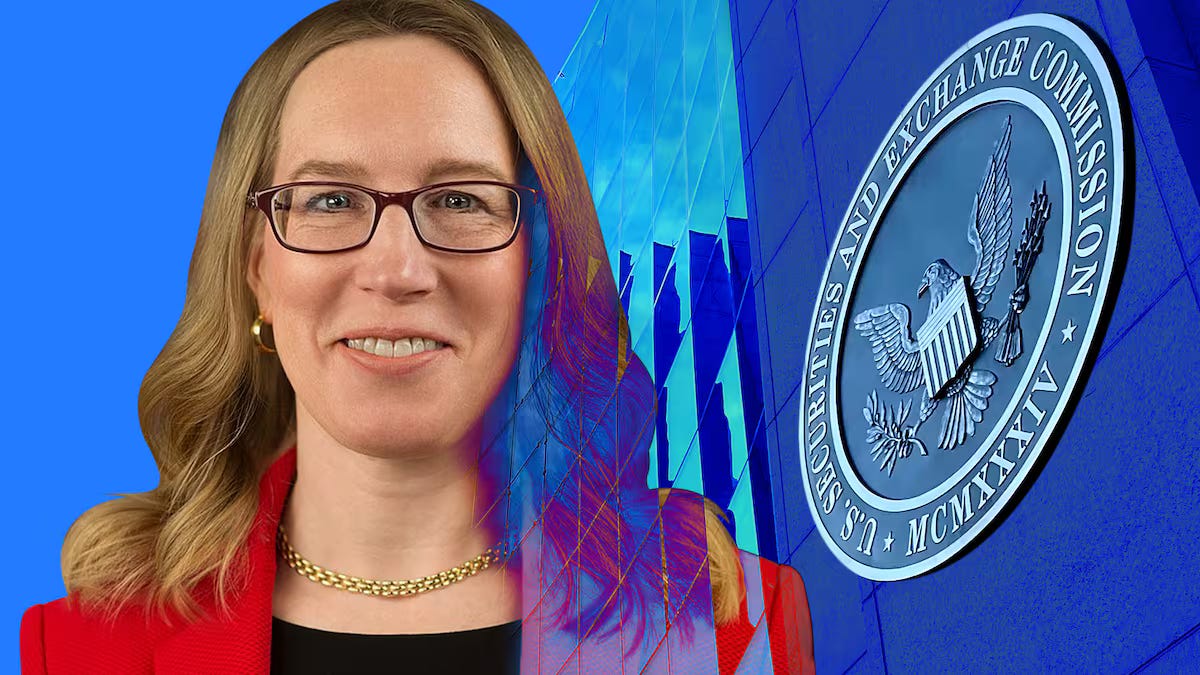

The regulatory landscape for digital assets has long been a source of frustration and uncertainty. The U.S. Securities and Exchange Commission (SEC), known for its often rigid stance on crypto-related innovations, has historically opted for enforcement actions rather than proactive rulemaking. However, a recent move by SEC Commissioner Hester Peirce signals a potential shift in strategy—one that invites the industry to actively shape the future of regulation.

On February 21, 2025, Peirce issued a Request for Information (RFI), seeking public feedback on various aspects of digital asset regulation. Her statement, aptly titled “There Must Be Some Way Out of Here,” underscores the urgent need for clearer, more adaptable regulatory frameworks. In it, she acknowledges that the current approach—largely defined by enforcement actions and ambiguous guidance—has stifled innovation, driven businesses offshore, and left investors in a precarious position.

A Call for Industry Participation

Peirce’s RFI represents a rare opportunity for industry participants—founders, developers, investors, legal experts, and other stakeholders—to voice their concerns and recommendations directly to the SEC. Unlike previous regulatory actions that have often left companies reacting to enforcement rather than engaging in constructive dialogue, this initiative provides a platform to advocate for policies that support responsible innovation.

The RFI seeks insights on several key areas, including:

Market Structure Considerations for Digital Assets: What adjustments should be made to existing market regulations to accommodate digital assets? Are current trading, clearing, and settlement mechanisms compatible with blockchain technology?

Custody and Safekeeping of Tokenized Securities: How can custodial standards be modernized to reflect the unique properties of digital assets? What safeguards are necessary to ensure security and compliance?

Disclosure Requirements and Transparency: How can disclosure frameworks be tailored to provide meaningful transparency without imposing unnecessary burdens on issuers?

Potential Modifications to Existing Regulations: What regulatory exemptions, amendments, or new frameworks are necessary to foster innovation while maintaining investor protection?

The Stakes: Will the SEC Finally Embrace Regulatory Clarity?

Peirce has long been a proponent of a more balanced approach to digital asset regulation. Her dissenting opinions in numerous SEC enforcement actions reflect her belief that the agency’s approach has been reactive rather than constructive. The RFI signals her continued effort to push the Commission toward a regulatory model that is predictable, transparent, and conducive to growth.

The digital asset industry has been at a crossroads. While innovation continues at a rapid pace—driven by advancements in tokenization, decentralized finance (DeFi), and blockchain infrastructure—U.S. regulatory uncertainty has forced many businesses to relocate to more crypto-friendly jurisdictions. This exodus of talent and capital poses a long-term risk to America’s leadership in financial technology.

If industry stakeholders seize this moment and provide robust, well-reasoned responses to the RFI, the SEC may be compelled to reconsider its approach. A well-crafted regulatory framework could pave the way for:

Greater institutional adoption of blockchain-based assets

A more competitive U.S. digital asset market

Enhanced investor protections without stifling innovation

A departure from the current reliance on regulation by enforcement

How to Get Involved

For those who have long been frustrated by the SEC’s approach, now is the time to act. This is one of the most direct opportunities to influence policymaking at the Commission.

Submit Your Input Here: SEC Public Comment Portal

Request a Meeting with SEC Staff: Meeting Request Form

Read Peirce’s Full Statement: SEC Website

Final Thoughts

Commissioner Peirce’s RFI could be a turning point for digital asset regulation, but only if the industry steps up and makes its voice heard. The alternative is continued regulatory ambiguity, stifled innovation, and a persistent game of enforcement cat-and-mouse.

If you care about the future of blockchain and digital assets in the U.S., take this opportunity to engage. A more thoughtful, innovation-friendly regulatory framework won’t emerge on its own—it requires proactive industry participation.

The SEC is listening. The question now is: will the digital asset community speak up?