Traditional to Digital: A How-To Guide for Transforming a Cap Table to Offer Liquidity on an ATS

Vertalo's support of XY Labs' trading exposed unique challenges and prompted Vertalo to develop approaches that will benefit many companies that want to make their equity liquid. Here's how we did it.

By Vertalo Team

In Theory

The transformation of a cap table from analog to digital is, in our opinion, one of the most practical and easily conceptualized applications of blockchain technology within capital markets. The recording of a snapshot of ownership, at a given moment in time, to a blockchain, is extremely useful for proper securities records management. While we don’t have a confirmed source for this, we’ve heard anecdotally that Facebook, now Meta, spent a whopping $100M remediating their cap table prior to their IPO.

That is astonishing. And such a waste.

As far as equity management goes:

who owned

what assets

how much of it they owned

at what time

for how long

when or if they’ve transferred it

and to whom they transferred it to

…are core & functional problems that blockchain was designed to solve. This was precisely one of the primary reasons Vertalo, Securitize, Tokensoft (who sold their transfer agent / regulated business operations to INX), and now many others, have been formed - to take a state-database snapshot of asset ownership at a given point in time. As changes to the cap table occur, they can be recorded and verified, confirmed through cryptographic key management and proper security protocols for those involved, most notably, the issuer, broker-dealer, transfer agent, or asset custodian.

Contrarily, a privately managed database is subject to changes at the whim of whoever owns or manages the database. Now, making illicit or unapproved cap table changes is a form of securities fraud, and there are plenty of existing methods for adjudication or legal redress should that happen, but one of the foundational pillars underpinning the entire blockchain movement is transparency. Another is the idea that mathematics and cryptography is a method for verifying legitimate transactions while removing the inherent trust found within capital markets applications.

In the preface to “Applied Cryptography”, Bruce Schneier gives us this thought-provoking insight:

“It is insufficient to protect ourselves with laws; we need to protect ourselves with mathematics.”

Blockchain offers this promise by acting as a database with the unique properties of historicity, transparency (where updates are concerned, specifically the transfer data and which party enacted the transfer), and its immutability. So much has been written on this subject we won’t go into more detail, but the benefits here are obvious. To reduce fraud, confusion, and illicit behavior, as well as increase trust, transparency, and audit-ability, public permissionless blockchains with private permissioned protocols can serve as an outstanding ledger for capital markets transactions.

Balaji S takes this a step further in his excellent thought piece, The Mirrortable. He envisions a future whereby all ownership data could be recorded to the blockchain, secured by the cryptography of the chain, verified and historical due to the chain’s immutability, giving more sovereign ownership over assets to the shareholder and disintermediating unnecessary (see: rent-seeking) third parties that are simply holdovers from a legacy system. While we don’t agree with everything in his piece, particularly how he assumes compliance will be handled in this hybrid system, he comes surprisingly close to the future that most of us imagine, specifically more:

Transparency

Accessibility

Flexibility

Sovereignty

…over one’s financial assets. All things we 100% support when it comes to the future of finance and how the layperson interacts with financial institutions and products on a daily basis. The idea of a hybrid financial system, that uses blockchain, cryptography, private databases, and regulatory licenses, is incredibly appealing.

While we don’t believe market participants or regulators will ever be comfortable with a fully sovereign financial system in the way that most of the crypto market operates today (think bearer instruments like Bitcoin that are exclusively under the control of the wallet holder, that are therefore sovereign, but also irrecoverable) we do think there are great strides to be made in streamlining legacy processes and reducing friction within private market transactions of all varieties.

In Action

XY Labs’ listing on tZERO was a big moment for the blockchain-based securities industry. It was the largest digitally enhanced dematerialized securities issuance in history, at roughly 24,000 shareholders, due to the successful Reg A+ that XY Labs had conducted back in 2019. They had initially approached tZERO about listing their Common Stock after the completion of their Reg A+ in 2019, but tZERO wanted to see more operating history and better underlying financials before feeling confident in the potential success of a listing, something tZERO refers to as “Direct Trading”.

After several years of operating, with many ups and downs, tZERO and XY Labs both felt ready to move forward with listing their Common Stock for “Direct Trading.”

A brief note on Direct Trading

Those who have read our writing will know we place a high premium on definitions and specificity of language. We freely admit that when speaking, especially if it’s about something we’re fired about or knowledgeable on, we sometimes ignore this and mince words or cross definitions mistakenly, but this is what we love about the written medium. It gives us a chance to revisit, redefine, clarify, or otherwise explain a position that we may hold. Let’s explore the definition of Direct Trading (what we support for XY Labs) vs. a formal Direct Listing.

Direct Listing vs. Direct Trading

A Direct Listing is a form of public offering whereby an issuers shares can be made publicly available for purchase, selling, or trading, but they differ from a traditional IPO in that no new shares are created as part of the offering. Put another way, a Direct Listing does not seek to raise additional capital for the issuer, but simply allows for the issuer’s shares to be freely tradable on exchanges.

Additionally, sometimes in a Direct Listing scenario, the traditional IPO methods, including:

Working directly with an investment bank to value the shares and company market cap

Plan for the go-to-market price, including marketing

A lockup window, preventing existing shareholders from dumping their holdings onto the market on opening day

The 6-12 month roadshow to garner interest from large institutions, pension funds, and other purchasers who would buy large swathes of shares, and

The presale of the shares to the investment bank, who then offers them upon listing day to those whom they helped build interest from

…can actually be ignored. Instead, shares are directly listed on a stock exchange on a predetermined date for purchase from the general public, both from retail traders and would-be buyers of large numbers of shares, like pension funds, endowments, or large corporate treasuries.

The Direct Listing process still includes massive commercial marketing efforts to beget buy interest and excitement on opening day, but has the ability to disintermediate the traditional investment banking process that typically accompanies an IPO, as well as the issuance of new shares to be purchased for fundraising purposes.

This is appealing for issuers since the investment banking costs, usually taken as a percentage of the transaction, can get very expensive. Indeed, it’s true that most companies under $1B valuation can’t go public, since the investment banks who would lead that process won’t make their fees on the IPO itself. Conversely, direct trading fees are highly predictable and uncorrelated to the size of the asset onboarding to the trading venue, making this ideal for smaller private companies. Additionally, there are much lower minimums in terms of float and asset value that can pursue liquidity, which again lends itself to smaller private companies.

Some of the more famous Direct Listings include companies such as Slack, Spotify, Palantir, and Coinbase.

A thought on Coinbase - we hold Brian Armstrong and the entire Coinbase executive team in high regard for remaining strong and performing Coinbase’s IPO as a Direct Listing rather than traditional IPO. Undoubtedly their executives had every investment bank on the planet vying for the opportunity to underwrite a traditional IPO, which would have netted the bank anywhere from $30-50M guaranteed, plus additional take based on performance the day trading goes live. But no, instead, Coinbase chose to back into a price per share by getting creative and using an ATS to achieve price discovery. They allowed their employees to list shares on an ATS, Nasdaq Private Market (NPM), and sell those shares within specific trading windows several days per week for four weeks in a row. Employees were only allowed to sell a certain portion of their holdings, and over four weeks of preliminary trading totaling roughly 1200 transactions, they were able to back into the $250 price-per-share on opening day for COIN listed on Nasdaq.

The ability for Coinbase to side step investment banks and offer a direct-to-market option goes to show just how powerful Direct Listings can be. We expect to see more and more companies choosing this alternative public offering route over the traditional IPO, especially as the core tenets of blockchain (disintermediation, transparency, and accessibility) continue to grow widely in the market.

See also: Coinbase 'IPO' Isn't an IPO. Here's Why That's Important

In effect, “Direct Trading” is the private market version of a Direct Listing.

Some in the blockchain-based securities space use the words “Direct Listing” to refer to “Direct Trading,” but that is not, definitionally speaking, accurate. This is why tZERO and others in the industry use the alternative wording of “Direct Trading” to refer to this public-like environment where a class of shares, usually Common Stock, is available on an ATS, but the company is not yet a fully public reporting company in the eyes of the SEC and FINRA.

For our purposes here, we’ll use “Direct Trading” to refer to how we worked with XY Labs & tZERO to support their trading objectives.

XY Labs’ Vision

To start, let’s examine why XY hired Vertalo in the first place, since their motives were a driving factor in the decision making process. Surely there are many transfer agents out there who would have gladly bid for XY’s business - it was definitely an appealing cap table at north of 24K shareholders. So what were their primary goals? During the initial engagement process, we broke them down together like this:

As you can see, we planned for a phased approach that allowed us to build together in stages (for product purposes we “bucketed” them as labeled here) in order to support what XY Labs needed from us, with a plan to implement new features along the way. We’ve heard this referred to as “land & expand” - you win an account and then continue to deliver value and expand your product offering, allowing your client to realize more value and for you to increase revenue from an existing customer.

XY’s goals required that we stage and plan for the following steps to fully execute against their vision:

Data Hygiene

Extraction and clean-up, especially in supporting XY’s transition away from their legacy transfer agent and to Vertalo as a digital transfer agent

Data Management

Investor account management, including employees with options and shareholders across multiple share classes

Transformation

Fully dematerialized (no paper) & digital support (digitally enhanced) of existing share classes and assets

Consolidation

XY wanted one repository of truth for shareholder information, since they were previously handling multiple “source of truth” (as oxymoronic as that sounds, different classes had different sources of truth based on capabilities from their respective provider)

Transfer Agent Migration

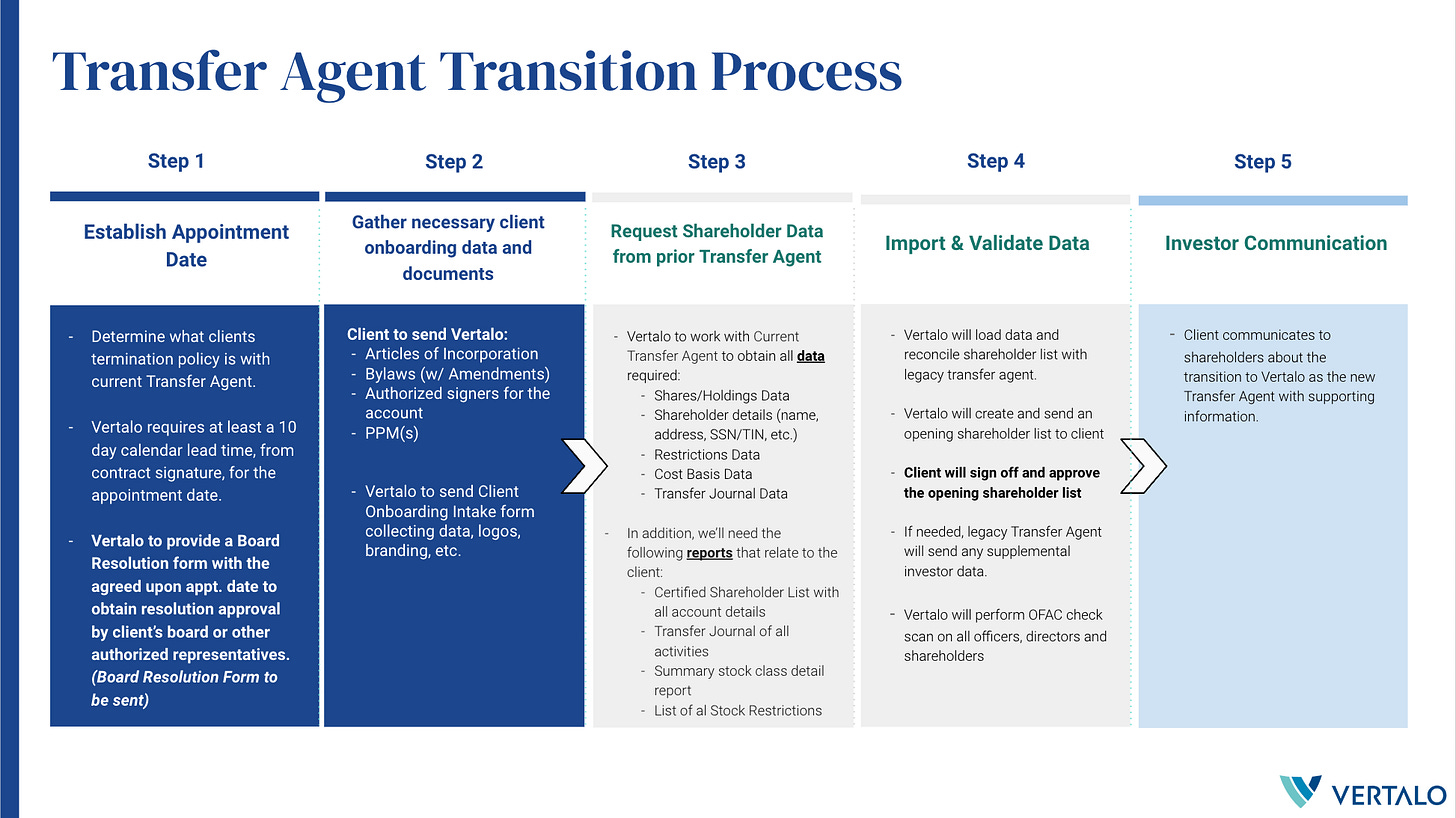

This is typically the most time-consuming part of the process when moving from the analog to the digital world. Vertalo has completed this process many times with all sorts of customers, and this is an example screenshot of the process we run when performing the migration:

This migration includes the following steps:

Establish an appointment date. This includes informing the DTCC of the change of transfer agent after a board resolution can be proposed and ratified. We require at least 10 calendar days in lead time from the time of signature to the appointment date, to guarantee we can properly support all compliance requirements for an issuer.

Gather necessary client onboarding data & documentation. Clients let Vertalo know the board meeting was held, Vertalo was instated as the transfer agent, and there is a written board resolution as a confirmation thereof. This allows us to commence gathering the shareholder data.

Request shareholder data from previous transfer agent. This effectively kicks off the ETL (extraction, transformation, loading) process, where we start examining the state of the data, particularly the integrity of it, as well as search for discrepancies or plan for how to handle inconsistencies.

Import & validate existing shareholder information. The bulk of our work really occurs here, where we extract, transform, and load the data into our system. Once this is completed we have the issuer confirm the accuracy of the data, after which we can invite investors to login and see their positions.

Investor communication & platform invitation. This is the final step of the process whereby investors are able to use the Vertalo platform, branded for the issuer via simple whitelabel or full-bore API integration, to log in, view their holdings, or initiate a transfer.

Extraction, Transformation, & Loading Process

After the appointment and necessary documentation and disclosures, we set to work on gathering the existing information for XY’s existing shareholder base. This was an interesting and entertaining exercise, since we were working from not one, but two, sets of data. XY Labs had previously done a migration from a cap table management service provider to one of the largest transfer agents in the world, thinking that this migration would satisfy their needs for their cap table management, including stock option exercise management, multiple share classes, differing conversion rates, and purchase & paid-in-capital records that varied fiercely across their multiple rounds of fundraising. It was quite a process of compilation and diligence.

When we received their official ledger for the bulk of their common and preferred shares, we began the extensive process of parsing data into a formatted cap table we could properly ingest and upload into our system.

Legally, part of transfer agent → transfer agent migrations include the TA being let go offering all cap table data to the new transfer agent, but that doesn't mean they have to be helpful or supportive; they are being fired after all. Thankfully we didn’t hit any speed bumps with their legacy TA being unwilling to help us, instead we found that generally they were very willing to answer questions and help with the transition.

Funny anecdote: The file we received was a fixed-width format file and was very difficult to work with, after some handwringing and attempts to manipulate the file in the way we needed one of our engineers exasperatedly exclaimed,

“What the **** even is this? A data file from 1994?!”

Never a dull moment in technology.

Restricted Accounts

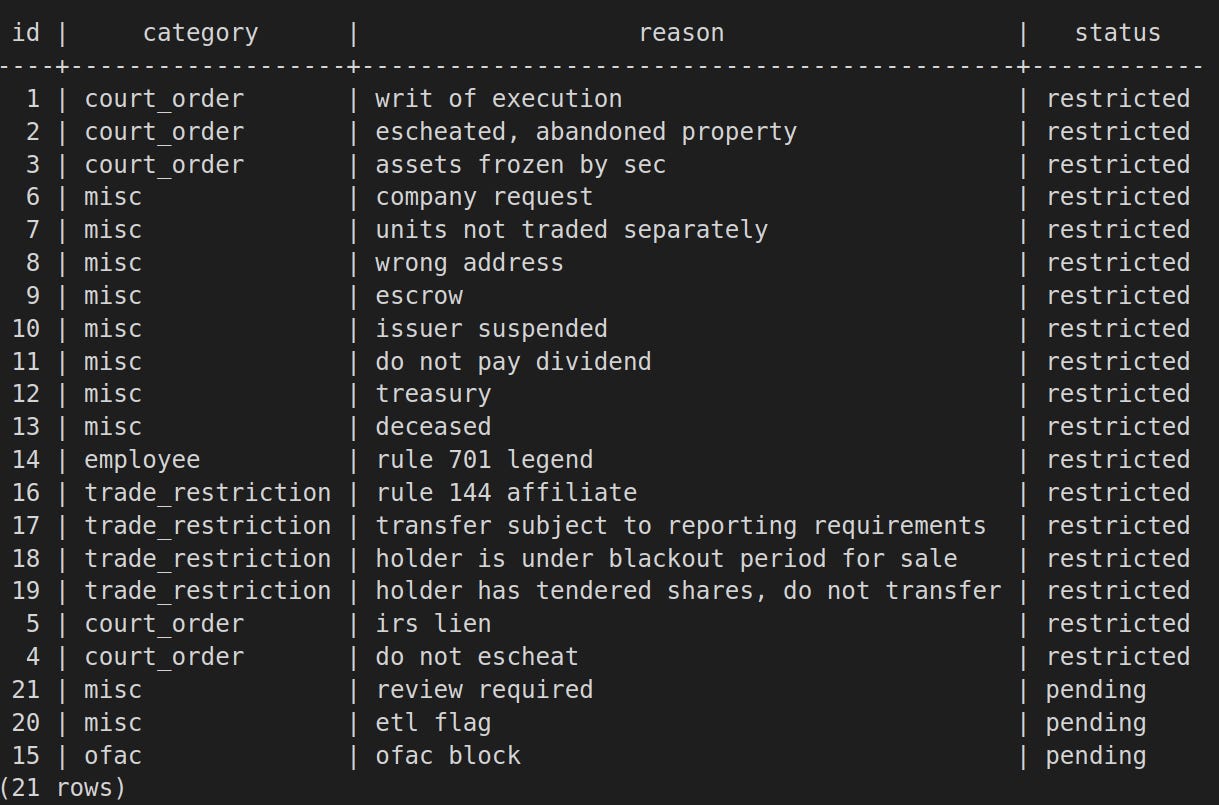

One of the factors of the cap table data that we needed to dissect included restriction codes listed for why investors accounts have been restricted. To give you an idea of how these codes typically work, here is a sample (although not fully exhaustive) list of Vertalo’s active account restriction codes:

If investors trigger flags for any of these reasons, our compliance team can force an account review to examine the flag and take appropriate steps. During the import process, we realized that the legacy transfer agent had over 350 restriction codes! Many of these codes were so similar from one to the next that we couldn’t understand why they would have a separate code for the same restriction. For example, one investor account may have been restricted under code “OFAC Restriction”, but another would say, “Office of Foreign Assets Control - Restricted.” Of course, these are the exact same restriction, just filed under different names, making understanding the state of your cap table, and reporting, quite difficult. We found deciphering the variables or reasons for why restriction codes varied when they seemed to be the same, a challenge to say the least.

At one point we encountered a restriction code that read, and this is a direct quote,

“Go ask Chris”

We’re sorry…but who on earth is Chris?! What are we even supposed to do with that kind of information as a restriction? It was wildly unhelpful and added confusion and uncertainty to our process, from start to finish.

It was at this point that the bulkiness and existing architecture of the legacy transfer agent world became even more clear to us and members of our product and client success teams. If a transfer agent can restrict an investor’s holding on the basis of, “Go ask a random employee why this is restricted!” what else is happening that is similarly restrictive, on an entirely arbitrary basis? Put another way, within transfer agency, what could be made more efficient? Is there any value in having 350 restriction code types, if they could be filed under the same restriction, or that just complexity for complexity’s sake?

To be perfectly clear, our intention in asking this is not to demean or diminish legacy transfer agents, their technology stacks, or even the industry as a whole, but rather to stimulate critical thinking.

Doing things a certain way because “that’s the way it’s always been done” is not always a great reason to continue doing things in that same manner, and while the crypto industry is replete with examples of people pushing the envelope and seeking (and in many cases, failing) to build new products or create new processes in the place of legacy ones, we remain more steadfast and convinced that this industry as a whole is posed for radical and sweeping disruption after having a look at what the legacy players have done with their digital infrastructure and technology.

Not for nothing, but we look forward to the radical transformation that lies ahead.

Inconsistent File Formats

Another tricky piece of this when performing the ETL process was the fact that there was no clearly defined standard for the file formats from one file to the next. Even within a singular file format, we found inconsistencies in treatment that meant handling the files at scale (there were 24,000 shareholders after all) was very difficult.

Additionally, there was no single master file of all shareholders, but rather disparate pieces of a fractured master that had to be put together like a puzzle. Between the inconsistent formats, no single master, and a restriction code list that we’re not fully convinced wasn’t a practical joke of some sort, we ended up having to parse and assemble the data piece by piece:

Along the way we added tools and automation to our processes, enabling us to do this faster and with less learning for the next customer we encounter that looks similar. As of this writing, we’re proud to say we’ve done several additional large-scale ETL projects like this for other customers, and have continued to develop tools to support the process start to finish. And while the onus of technology development and implementation will remain on us, since we can’t imagine legacy players adopting *good* tech any time soon, that’s a function we’re happy to lead.

Stock Conversion

The final element to note here was the conversion of multiple classes of stock down to a single class of Class A Common Stock at shareholders election that could be freely traded on tZERO. Like many companies, XY Labs had issued different classes of stock with differing shareholder rights, the classes of which are not fungible with each other. Only one class was being opened for trading on tZERO, so shareholders who held other classes with conversion rights elected to convert their holdings in order to trade their positions. Vertalo supported these conversions, which increased the available volume of Class A Common shares for trading.

This conversion and collapse from multiple classes down into a single class allowed us to square the cap table, both from different classes of preferred, as well as from option holders, to support the free trading. In order to produce enough volume, it was prudent to convert any outstanding shares into Class A Common Stock where possible. Of course unvested stock options should remain as unconverted, and are not part of the cap table strictly speaking since they don’t represent issued shares, but the right to purchase the underlying (typically common stock) at a predetermined price. That said, for issued shares that could be converted, especially the previously issued preferred stock, this collapse & consolidation effort helped to drive more shares available for trading on the ATS once the asset went live.

Integration with tZERO Markets

The goal with XY’s listing was a “public-like” environment whereby the Common Stock of XY Labs could be freely traded, with orders matched on the tZERO ATS, that could be accessed by any prospective shareholder willing to create an account. This necessitated integration with their executing broker dealer, tZERO Markets, who stood between our transfer agent and their alternative trading system, tZERO ATS. The nature of our integration, and how we moved data between these three parties, including the asset tokenization itself, we intentionally leave out of this breakdown, as you’ll see below as well, in the vein of “protecting trade secrets” we keep some of the more specific details private.

If you’re interested in learning more about how trading tokenized assets on an ATS works, feel free to dig into this piece where we break down the various factors that influence the process, as well as how those factors change the models themselves.

Biz, UX, Integration, Legal

In order to properly onboard investors, we created a process that would allow us to support the regulatory requirements imposed on tZERO and Vertalo by the SEC and FINRA, pursuant to securities law in the United States. This required connectivity with tZERO Markets, which could then send orders to the tZERO ATS, who would match buy and sell orders, the result of which can then be settled, including cash moving and securities changing hands, by tZERO Markets. This process effectively took XY’s cap table from a stagnant to a dynamic one, with trading live right now available on tZERO.

In order to support this seamlessly, the process we designed had multiple inputs, including:

Business Considerations

Investor User Experience

Technical & Integrative Requirements

Legal Considerations

We keep exactly how this worked and the processes we created vague, out of respect for Vertalo, tZERO, and XY Labs, but we are immensely proud of what we were able to construct across all of these areas of input to fully support the trading of their asset.

Disclosure Requirements

Direct Trading, like what we did to support XY Labs, is sometimes referred to as “public-like” in terms of liquidity being added to a class of shares that can be purchased by any end investor. And similar to a fully public reporting company, the issuer of the stock has to complete due diligence under securities regulations to qualify to trade freely on an ATS.

tZERO has very specific disclosure requirements to qualify for trading on their platform, including diligence into the company, its officers, revenues and expenses, operating history, float, asset size, and others. The goal with these disclosures is to create some standardization from one issuer to the next, similar to GAAP accounting, allowing investors to make informed decisions, especially where risk is concerned, as they evaluate the pros or cons of buying or selling an issuer’s stock.

A benefit that accrued to XY Labs was that the regulatory requirements coming out of a successfully filed and completed Reg A+ meant that the standard disclosures required under 15c2-11, which is a securities requirement for Broker-Dealers offering quotations (order matching) for assets that trade, were easy to satisfy. 15c2-11 is usually associated with over-the-counter trades, but also encompasses orders handled on an ATS.

Learn more about 17 CFR § 240.15c2-11 - Publication or submission of quotations without specified information here. Additionally, Charles Schwab has a great breakdown of the restricted securities impacted by 15c2-11.

Reg A+ filings are more strict as a threshold and demand more information than are the standard disclosures cited under 15c2-11, which meant that XY Labs possessed plenty of audited information that tZERO simply had to confirm as legitimate, after which trading could commence. This reality can be highly beneficial for issuers that have conducted a Reg A+, since the ATS listing requirements are not as burdensome for a private company if they’ve already provided everything necessary to their shareholders as part of the Reg A+ registration and filing process.

From XY Labs COO Markus Levin,

“Working with Vertalo on the digital transformation of our cap table was a fantastic exercise, all things considered, especially since it was the second migration of its kind that XY had to complete. We were pleased with Vertalo’s willingness to work with the varying and incomplete data sets to guarantee our cap table was whole and could support the trading of our Common stock on an ATS to provide liquidity to our shareholders all while navigating a unique tri-party engagement.”

Conclusion

This process was so instructive for our team, as well as for our partners as worked through the many elements that made it possible to transform XY’s cap table from a traditional ledger into a full digitally enhanced non-certificated securities with a blockchain representation. The extraction, transformation, and loading of their cap table was quite an exercise, made more difficult because of outdated formatting, inconsistencies in data integrity, and a lack of clarity across different files that supposedly were pulled from the same master data set.

The integration with tZERO was especially illuminating for us as we worked with one of the approved and regulated models for trading private assets compliantly. tZERO was an excellent partner for Vertalo throughout the integration, with each party performing their respective duties, in an automated fashion, to support the liquidity of XY Lab’s Class A Common Stock.

Till next time.

Questions about tZERO, Direct Trading, and how to support liquidity for private assets? Feel free to reach out to Solomon Tesfaye, tZERO’s Head of Business Development & Capital Markets, or reach out directly to sales@tzero.com.

We can be found here on LinkedIn or Twitter.

If you’d like to speak with Markus Levin about XY Labs and their experience as an issuer listing on tZERO for Direct Trading, feel free to reach out to him on LinkedIn.