Vertalo Securities Protocol

A Solution for the Transition to a Tokenized Capital Market.

Abstract

As financial institutions (“FIs”) increasingly invest in developing infrastructure for tokenized assets, certain challenges have emerged with data management, regulatory compliance, and implementation. Before the benefits of tokenization can be realized by capital markets participants, the unique regulatory and data handling requirements of each party must be addressed. Legacy systems must be united under one highly compatible system, with considerations for the demands of each user type and anticipation for the rapidly evolving blockchain-based landscape.

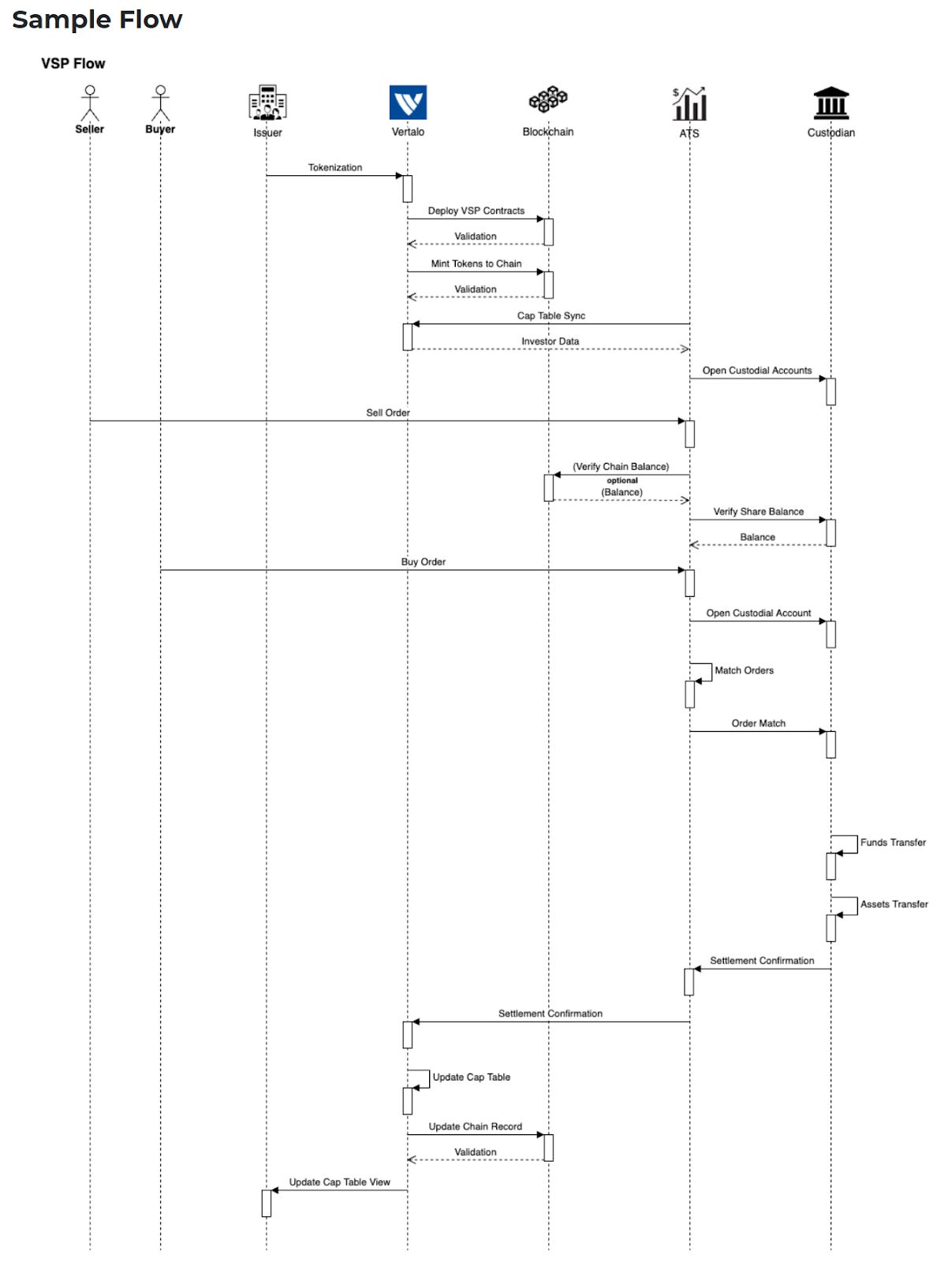

Vertalo Securities Protocol (“VSP”) is a flexible, extensible, multi- or single-tenant system that integrates off-chain and on-chain components to address the regulatory needs, technological demands, and emerging challenges of participants and service providers in the context of adopting tokenized assets in capital markets. VSP comprises a suite of smart contracts, paired with multiple offchain and middleware components that allows for both backward and forward compatibility with legacy and emerging technologies, regulatory compliance, and cross-chain capabilities. The VSP architecture accommodates both hosted and installed deployments, providing users with a range of options for their own control and security needs. Positioned between internal systems of FIs, external service providers, and blockchain networks, VSP allows its users to integrate tokenized asset infrastructure at scale with lower capital investment, reduced project risk, and high compatibility with existing and emergent blockchain networks.

Introduction

Tokenization describes the process of using distributed ledger technology (“DLT”) to create digital representations of ownership in the context of traditional financial and non-financial assets.

Opportunities and Challenges of Tokenized Regulated Assets

The tokenization of assets offers benefits in the form of efficient capital formation, reduced costs throughout asset lifecycle, heightened liquidity for trading, faster settlement, increased auditability, and lower liability for custodians and issuers. Tokenization is enabled by smart contracts, which allow for programmable and automatically executing transaction types that are highly adaptable to asset-specific requirements.

To realize the primary benefits of tokenization, multiple parties must be able to interact with the same underlying distributed ledger data while remaining in compliance with securities law. The open, peer to peer nature of public blockchain networks do not immediately provide for such regulated activity or permissioned access by default. Further, interested parties must adapt their legacy technology systems to be compatible with DLT, which requires significant capital investment, careful future-proofing, and technology risk.

Such limitations can be avoided through the implementation of VSP, which is flexible and extensible by design, regulation-aware, highly compatible with legacy systems and existing blockchain networks, and can be easily adapted for emerging networks. The Vertalo Securities Protocol can be applied throughout asset life-cycles, from asset issuance and initial capital formation, asset tracking and transfer, through secondary trading.

Tokenization Background

Cryptographically-secured distributed ledgers provide the foundation for issuing, exchanging, and tracking digital representations of ownership. In the context of contemporary blockchains, this has taken several forms, from transactional cryptocurrencies to non-fungible tokens. The same model of positive proof of ownership, recorded on a distributed ledger, and exchanged with rapid settlement times applies to traditional financial and non-financial assets. As such, commercial and central banks, corporations, and governments are increasingly investing in the development of tokenization technology and infrastructure to realize benefits associated with DLT.

The key distinction between tokenized assets and their conventional counterparts lies in their ‘representation’ of ownership. Traditional assets rely on centralized systems owned by specific issuers and companies, often leading to fragmented processes that necessitate third-party intermediaries. This tends to restrict efficiency, interoperability, and the potential for innovation.

In the case of tokenization, public blockchains and distributed ledgers operate on a decentralized framework available to all participants, thus potentially eliminating fragmentation and removing intermediaries. This results in enhanced efficiency, better interoperability, and a theoretically more conducive environment for innovation. Furthermore, this decentralized structure allows tokenized assets and funds to be used as collateral in emergent DeFi applications.

Digitization and Tokenization Benefits

Efficiencies: Digitized assets can be issued, exchanged, and have their record of ownership updated programmatically without requiring intermediaries. This automates certain manual processes, leading to lower likelihood of human error, reduced expenses for overhead, and lower liability costs in the case of mismanagement. Parties can use APIs to access a shared ledger housing a common data set. Tokenized assets additionally provide an immutable audit history on permissioned or permissionless distributed ledger.

Settlement Time: Programmatic settlement of digital assets can reduce settlement processing time to milliseconds. This significantly improves on the typical settlement times of T+3 in the case of securities transactions to T+7 in the case of some cross-border transactions. In addition to efficiencies and lowered costs, real-time settlement reduces the need and scale for clearing deposits and can increase capital turnover for FI’s. For tokenized assets, depending on the blockchain network utilized for exchange, settlement time can vary from milliseconds to minutes, also a dramatic improvement over typical settlement times.

Fractionalization: With appropriate platform support, digital assets can be fractionalized, allowing users to purchase assets in smaller increments. Reducing the minimum bid size increases at-the-market liquidity, lowers volatility, and allows for smaller retail investors to participate in previously inaccessible markets.

Liquidity: As digitized assets can be rapidly created and exchanged, previously illiquid assets can quickly find new markets. This reduces market fragmentation, facilitates greater asset velocity, and allows for faster capital reallocation. Permissionless DLT networks make audit history available globally, supporting the broadest possible liquidity options for tokenized assets.

Auditability: Tokenized assets provide shared audit history for an asset using DLT. This shared audit data enhances regulatory compliance, investor protections, and fraud prevention. There are two main audit-history models: full transaction history and checkpoint history.

Full transaction history records each transaction on DLT. In this model the DLT determines the limits to speed and scale of transactions, but all transactions are immediately auditable upon completion.

Checkpoint history records data on DLT that supports verification of off-chain transaction data. The off-chain data may come from any source, including an API-based shared ledger or a side chain, and the validation checkpoint is written to the main DLT on an algorithmic basis. In this model the DLT imposes no significant limit on the speed and scale of transactions, and all transactions are auditable upon checkpoint completion.

These models may be combined, for example with a side chain acting as the full transaction history for some parties, and the checkpoint covering one or more side chains. The choice of which combination of models to use is flexible and can address any specific application requirements.

Universality: Any asset, including physical assets, such as gold, real estate, and art, can leverage digitization and tokenization to achieve the benefits listed here. This allows for the creation of more efficient and liquid capital markets for all assets without exclusions.

Novel Financial Instruments: Smart contract technology and fractionalized assets serve as the basis for creating new financial instruments. This can involve combining fractions of various tokenized assets to create highly customized risk profiles, similar to securitization, or embedded programmable rights, conditions, or covenants that determine the instruments performance.

Blockchain Compatibility: Emerging technologies in decentralized finance allow for permissionless algorithmic lending, income generation, derivatives, or exchange. Tokenization supports this novel financial technology, leading to a broader set of opportunities for issuers, investors, and asset managers.

Challenges of Tokenization

Distributed ledgers are trustless in the sense that they are designed to eliminate a centralized point of failure through decentralization. These decentralized networks are inherently permissionless, which causes friction when met with centralized systems, such as internal ledgers of FIs, securities law, and the link between assets and their digital representations.

Regulatory

Globally, the absence of synchronized regulatory structures is the biggest short-term barrier to the transnational acceptance of digital assets. Differing regional regulations remain a challenge for creating a global tokenized asset market.

Regulatory intricacies could hinder the transition of conventional assets into tokens, mainly due to varied regional regulations and ambiguity in token classification.

Whether tokenized assets are to be treated as securities or commodities, the set of applicable regulations is too large to embed in the token implementation without hindering speed or cost.

The legal aspects of asset ownership, particularly with distributed ledgers, are still vague. Further, the legal standing of smart contracts, especially concerning the transfer of assets, remains ambiguous. Decentralized oracles provide advantages, but without clear accountability, especially in cases of malfunctions or manipulation.

Technological

Legacy technology stacks of existing capital markets participants and service providers will need to be made compatible with DLT. The fragmentation of existing systems hinders the broad adoption of a singular standard.

There is not yet a broadly adopted universal token standard that confers the technological benefits and accounts for the unique needs of each user type. Many models have been put forward as a potential standard, but each has limited adoption. This has led to numerous “standards”, all with tradeoffs on cost, scalability, and compliance.

Security Concerns

Major security breaches, even if infrequent, could deter mainstream institutions from embracing DLT.

The very nature of software makes it prone to vulnerabilities, which can shake industry credibility, even with protective measures like bug bounties, audits, and insurance.

Cross-Border and International Implications

Coordination: Without international coordination on common standards with regards to industrial and regulatory consensus, the full potential of tokenized assets may not be realized. So-called ‘Walled Gardens’, non-interoperable platforms, jurisdictional restrictions or exclusivity can hinder competition, introduce new forms of friction, and slow global financial adoption.

Liquidity: Tokenizing assets can facilitate the formation of secondary markets, but without liquidity, there is little purpose of tokenization. Liquidity issues might diminish as adoption increases, but it's essential to ensure interoperability to prevent fragmented liquidity.

VSP Key Components & Architecture

The Vertalo Securities Protocol seeks to confer the benefits of tokenization on any SEC Registered Transfer Agent while addressing the challenges. Through a highly customizable, API-based, multi- or single-tenant database system that combines a suite of on-chain smart contracts, off-chain database elements, and middleware layers, such as oracles, VSP is able to meet the unique demands of various user types, asset classes, asset lifecycle stages, and jurisdictional regulatory schemas.

VSP is hosted in an off-chain environment with advanced capabilities for reading chain data, syncing its internal or instantiated database with such data. All on-chain events are recorded, and stored in alignment with existing regulatory and jurisdictional structures, enabling users to realize the efficiencies of digitization and tokenization without needing to face the challenges of fully on-chain apparatuses.

Unlike competing technologies that encode all pertinent data on-chain, VSP does not solely rely on chain data, which can become expensive, slow, or experience downtime. The minimum viable on-chain datum for tokenization is simply, “balance”, which VSP reads and writes. In the context of contemporary blockchains, writing additional chain data results in heightened costs and a dilution of benefits. VSP can write additional data to chain, and this system configuration is customizable to the user’s needs, asset class, regulatory requirements, network configuration, etc. As such, VSP presents a flexible, chain-agnostic solution that combines on- and off-chain elements to meet the emerging demands of tokenized asset market participants and service providers in the context of today and tomorrow.

Order-Ensured Eventual Consistency

All events, such as issuance and transfer, are produced and stored off chain for regulatory and liveliness reasons. Off-chain redundancies ensure that transfer agent operations continue if distributed ledger services become unavailable or corrupted. These records are synced to chain whenever possible, in the correct order, including in cross-chain operations. With the constant availability of this backing event log, VSP can be adapted to emerging blockchain networks, including permissioned ledgers in development at many financial institutions and central banks.

Extensibility

Unlike competing approaches, VSP extends beyond smart contracts comprising a set of tools designed to broadly support all tokenized assets in anticipation of multiple token standards and blockchain-agnostic operation. As such, VSP is designed to be future-proof, with robust capabilities for syncing data from chain data to real investor data. VSP was purpose-built to be extensible across all systems with highly patterned configuration and coding.

Oracle-Based Compliance

As the regulatory paradigm varies by market participant (i.e. Broker-Dealer, Custodian, ATS/Exchange, CSD, etc.), the complexity of meeting all regulatory requirements for all parties becomes increasingly expensive and deleterious when managed solely on chain. While capable of writing such data to chain, VSP defaults to middleware, such as oracles, for referencing off-chain data to align with jurisdictional regulatory requirements. Only the highest-value data is stored on-chain, which is a user’s balance. This lightweight and cost-effective solution is highly compatible with currently available blockchain architectures, and provides forwards-compatibility with emergent projects.

Multiple-Chain Support

The components of VSP that interact with blockchains are simple adapter implementations. In almost all cases, writing to a chain or ledger is the same concept, from paper to Ethereum to any other public or private distributed ledger. The data calls may differ, but the process is preserved across these models. As such, VSP smart contracts can be adapted to any smart-contract enabled network and event. This pairs well with supporting event readers. The combination of these on-chain and off-chain event handling components ensures that VSP can operate across multiple blockchain environments seamlessly.

Capabilities

Version Control for Smart Contracts

VSP utilizes a suite of proxy upgradable smart contracts. This reduces the risk of errant deployments, and it is useful in the event that API’s relating to the system change for regulatory or other reasons. VSP smart contracts include storage and a basic parsing layer that can inform chain readers how to parse events from the chain. This version control is configurable via environment and can be used for rapid development, testing and promotion of smart contracts. VSP’s version control is configuration-driven to support different data storage formats.

Smart Contract Deployment

Each tokenized asset on VSP has its own smart contract. To facilitate this, VSP features a deployment contract to dynamically generate smart contracts for each asset. These are presently one-time use, but may be enabled as factories. There is a distinct on-chain event that allows VSP’s off-chain components to monitor compatible contracts with no off-chain API interaction.

Role Based Access on Chain

Permissions for function execution are role-based in most cases. (Public ERC-20 functions are the exception.) Role-based permissions use a whitelist of blockchain addresses per smart contract function to delegate execution permissions. This allows for easy construction of smart-contract constellations that can operate on each other in new and dynamic ways. This also allows new smart contracts to extend, encapsulate, change or remove behavior, with a high degree of user control.

Reading Chain

Chain readers and uncle block detectors are included in VSP in order to ensure off-chain events are written to chain, with conversion to the appropriate byte formats, and the next event triggers. Chain readers also provide the capability to check the chain for write completion, and retry when needed. VSP implements this functionality programmatically to ensure seamless operation.

Parsing Contracts

The proxy-upgradable smart-contract model includes parsing of smart-contract events. This allows the VSP chain readers to parse events that are supported by the VSP version control. The VSP version control is configuration driven, to support different on-chain data formats.

Fail-Safes

Vertalo Securities Protocol has several built-in fail-safe features, including defensive design, pause functions, proxy upgrades, and delegating critical functions to off-chain elements. VSP’s off-chain elements securely and efficiently handle critical data. Should chain data become corrupted or unavailable, VSP’s off-chain transfer agent architecture insures against loss of ownership data. Any smart contract vulnerabilities can be mitigated through this approach, or quickly addressed through proxy upgrades.

Implementation

Owner

The owner of a smart contract is a single designated blockchain address, not a role. It cannot set roles but can update the contract’s owner address in order to transfer ownership. This supports use cases in which the storage contract must be held by a custodian, or the ERC-20 by an exchange.

Permissioned Collaboration

The admin role can manage delegation of permissions on a VSP smart contract to blockchain addresses. Delegation allows an address to exercise a smart-contract function. Multiple parties can collaborate through exercise of functions for which they have permission on a common smart-contract.

Extension to New Functions

The owner can deploy a new smart contract and register it with the main VSP contract, allowing the main contract to call functions from the newly-deployed smart contract that comply with existing VSP version control; all events it produces are available automatically. Non-compliant events can be handled with parsing extensions.

Flexibility & Extensibility

Backward & Forward Compatibility

VSP’s combination of on-chain smart contracts and off-chain components provide a unique profile of backward and forward compatibility. Through API’s and oracles, VSP can be backwards compatible with any legacy infrastructure. As the off-chain environment may change, with regulation for example, oracles can facilitate the necessary compatibility. Further, the proxy upgradeable smart contract model allows for ongoing changes to smart contracts, which provides forward compatibility as necessary.

Use Cases

The VSP implementation is flexible enough to cover a range of use cases, in anticipation of ongoing user adoption and technology evolution. VSP can adapt to changing regulatory and legal landscapes, as well as to new use cases, using the appropriate combination of on- and off-chain capabilities.

Cap Table Management

As companies must maintain their internal shareholder ledgers, VSP can be used in off-chain and on-chain contexts. VSP provides for the ability of users to maintain accurate and auditable records with all the functionality of cap table technology. This includes issuance, secondary transactions, options vesting, etc. This cap table management functionality can be paired with on-chain elements for connections to secondary markets. VSP provides streamlined workflows and automated data handling, eliminating paper-based and error prone record management processes. Streamlining shareholder management drives value by optimizing existing cost centers, heightening back office efficiency, and reducing cycle times for managers, while providing immediate access to blockchain-based secondary markets if needed.

Asset Management

Asset management involves managing the lifecycle of assets through issuance and secondary trading. VSP is uniquely capable of allowing users to manage tokenized assets at any stage of their lifecycle. Assets that have already been issued can be adapted to tokenized form, or newly issued assets can begin their lifecycle as tokens on the VSP platform. VSP’s flexible architecture can be adapted to any legacy technology system for asset management, and provides a high degree of compatibility with any public, permissioned, or private distributed ledger.

Cross-chain interoperability

As the landscape of distributed ledger technology continues to develop, VSP’s unique architecture is designed to evolve with it. VSP provides for cross-chain interoperability, which provides users with more control over which network they wish to support tokenized assets on, as well as future-proofing clients against emergent networks which may ultimately drive the most adoption. This flexibility also extends to private networks, which FIs and Central Banks are developing internally.

Differentiating Factors

VSP differs significantly from alternative systems in several respects. To date, most tokenized-asset protocols are standalone technology stacks with little backward compatibility to existing systems. Rather, they are deployed as bolt-on parallel systems that are independent of users’ business demands. VSP is designed for simple integration to any legacy technology system through API, or other form of adaptation of off-chain elements to a user’s existing infrastructure.

Previous systems have been designed with the intention of becoming the sole standard in tokenized asset technology. Many embody specific views of regulatory compliance and DLT integration, and lack forward compatibility with emerging blockchain innovation in public or private networks. VSP is designed to be redeployed rapidly across a quickly evolving regulatory and technological landscape. VSP is highly configurable and is designed for dynamic adaptation as the state of tokenization technology advances.

References

BCG, ADDX: Relevance of On-Chain Asset Tokenization in ‘Crypto Winter’

https://web-assets.bcg.com/1e/a2/5b5f2b7e42dfad2cb3113a291222/on-chain-asset-tokenization.pdf

GFMA: Impact of DLT on Global Capital Markets