Vertalo’s Digital Transfer Agent

Revolutionizing Transfer Agent and Back-Office Operations in Private Asset Management

Abstract

Since the early days of Wall Street, when telegraphs delivered stock quotes from New York to Boston and curbside brokers traded off-book on the street outside the NYSE, there has been a persistent pursuit to create order out of chaos in the financial markets. This mission over the years has introduced third parties to participate and decrease risk in capital markets such as custodians, central securities depositories, clearing houses, and Transfer Agents.

A Transfer Agent (“TA”) records the ownership of a securities issuance. They issue and cancel certificates, add and remove trading restrictions on securities, record transfers of securities ownership, and more. Non-bank transfer agents generally are regulated by the U.S. Securities and Exchange Commission pursuant to rules adopted under Section 17A and 17(f) of the Securities and Exchange Act of 1934 (“Exchange Act”).

Fulfilling these responsibilities once required the creation of physical stock certificates with seals of authenticity, information about the issuer, and signatures from corporate officers that were mailed to investors or their broker or custodian. Many of the inefficiencies this process introduced have been mitigated with the introduction of electronic record-keeping of “book-entry,” meaning non-certificated, securities. However, by no means did this rid the TA and broader capital markets system of friction.

Most TAs now use some form of ledger software to maintain securities ownership records, which alleviates some but not all of the burdens of investor data management. Although electronic, these instanced books often still require manual entry, adjustments, and data sharing. Though these systems solve many of the integrity and operational struggles of the days of telegraphs and physical vaults, there is of course always still room for improvement as our technological world continues to advance. The process of manual entry and maintenance within these systems creates inconsistencies and errors that hold up securities transactions, especially in private markets. In particular, data sharing among other market participants - such as fund admins, alternative trading systems, custodians, and brokers - often proves difficult in the process of ETL (extract, transform, load) of data between disparate systems of firms.

The most obvious solution to these problems is to utilize a software platform that automatically and instantly validates and shares data with a similarly equipped counterparty. A computerized ledger with adequate and automated checks and balances yields better reconciliation and interpretation than even the best hands on keyboards.

For these reasons and the others detailed in this paper, Vertalo designed and purpose-built their platform from inception as a “Digital Transfer Agent.”

The Vertalo ledger platform is API-first and blockchain-enabled, creating technical integrations with all of the market participants listed above and, moreover, can be implemented within an institution’s own secure computing environment. The platform solves many of the inefficiencies of manual data entry, transport, and validation for private capital markets by serving as a Golden Source for securities and asset ownership records for issuance, secondary trading, and more.

Introduction

In recent decades, Financial Institutions (“FIs”) have grown exponentially in the complexity of assets, trading mechanisms, and global reach. Transfer agency and private asset data management stand as crucial backbones of the financial system. However, despite their importance, these two areas have been starved of adequate technology investment, resulting in unnecessary cost and systemic friction.

Problem: Antiquated Data Management Practices

The evolving financial landscape demands sophisticated technological solutions to cater to the intricacies of TA operations and private asset data management. However, legacy systems and traditional practices remain prevalent within many FIs, leading to several notable inefficiencies and challenges.

This section covers the following challenges presented by the lack of investment into private markets data management:

Incompatible Infrastructure

Data Silos and Fragmentation

Lack of Standardization

Inefficient Data Reconciliation and Management Processes

Compliance and Regulatory Challenges

Integration Challenges

Incompatible Infrastructure

At the core of most TAs is an infrastructure that has only received minimally consequential updates for decades due to established mainframes and security concerns. Such outdated, legacy systems can lead to slow transaction times, increased error rates, and an inability to integrate with newer, emerging technologies. These legacy systems often rely on manual processes, which are both labor-intensive and also prone to human errors. TAs and some legacy systems can utilize APIs but still struggle with systems integration due to incompatible datasets, over-fetching of data, and lack of customization or augmentation. Many APIs utilized today are traditional REST APIs, which are easier to use and appropriate for simple data sets, but are prone to over-fetching and often inferior to GraphQL query language, which is built for large, complex data sources like shareholder and security data. Queue messaging middleware infrastructure, commonly used in FIs, provides a streamlined mechanism for asynchronous communication, allowing systems and applications to efficiently exchange vast amounts of data. This is particularly useful for ensuring timely and reliable data transfer in a high-volume, high-velocity financial environment. However, when it comes to transfer agency and private asset management, there are distinct downsides. Middleware can sometimes introduce latency, leading to potential discrepancies in real-time data, which can be problematic for asset managers requiring instantaneous insights. Furthermore, while queuing ensures that messages are processed, it does not inherently guarantee the order in which they are processed, which can be critical for certain financial operations. The abstraction introduced by middleware can also reduce the granularity and immediacy of control, making it challenging to address specific transactional nuances or unique requirements intrinsic to private asset management and TA operations.

Data Silos and Fragmentation

A major challenge in the current TA and private asset management sphere is the prevalence of internal data silos. FIs often operate multiple, disjointed systems for functions such as trading, asset management, TA, brokerage, etc. This fragmentation can result in inconsistencies, discrepancies, and challenges in consolidating data for comprehensive analysis, which is critical as TAs must share data with the other operators servicing securities issuances, whether these departments are internal or external to the organization. In an era where integrated insights are the key to decision-making these silos and their lack of interoperability present a considerable bottleneck.

Lack of Standardization

FIs employ a multitude of platforms, APIs, protocols, etc. The absence of standardized data formats complicates data interchange/exchange between institutions. Although many TAs and legacy systems utilize APIs, interoperability challenges still exist due to lack of API standardization or ability to efficiently generate new, compatible APIs. This lack of standardization compounds the inefficiencies, often requiring manual intervention to reconcile data discrepancies.

Inefficient Data Reconciliation and Management Processes

TA operations require meticulous reconciliation to ensure accuracy in the representation of securities ownership and transaction histories. Legacy systems often entail manual or semi-automated reconciliation processes being used for this purpose which are both time-consuming and also susceptible to human error. These inefficiencies can lead to regulatory infractions, disputes, and diminished trust from clients. Additionally, private assets, by nature, do not have the same liquidity and transparency as public instruments. Data management of private assets is often fragmented across multiple departments or divisions within an FI. Poor data sharing capabilities and lack of interoperability leads to opaque views of asset information or NAV, delayed reporting, and potential misvaluation.

Compliance and Regulatory Challenges

The ever-changing regulatory landscape puts added pressure on FIs. Outdated systems hinder prompt adaptation to new regulations. Delay in adopting new compliance measures exposes institutions to legal risks and also potential financial penalties.

Integration Challenges

Adoption of emerging technologies such as blockchain has surged at FIs. Legacy TA and asset management systems often lack the flexibility to integrate seamlessly with these new technologies due to native complexity of their mainframe architecture. This gap can cause FIs to miss out on the benefits these technologies can offer in efficiency, auditability, and cost savings.

The Solution: An API-Based Platform with Flexible DLT Capabilities

The significance of efficient and secure data management cannot be overstated. As FIs grapple with increasing volume and complexity of ownership and transactional data, the need for streamlined (and implementable) solutions becomes paramount. The combination of API-based interoperability with the immutable and trustworthy nature of Distributed Ledger Technology (“DLT”) offers a most cost-effective and scalable alternative, especially compared to the antiquated technology offerings within traditional transfer agency platforms and private asset data management.

API Integrations and Interoperability

APIs have revolutionized the way disparate systems and platforms share and exchange data. In the context of FIs, this interconnectivity enables real-time data access and seamless integration across relevant departments or divisions within an FI’s TA and asset management operations.

By eliminating the need for manually-triggered data transfers or cumbersome batch processes, FIs can substantially reduce operational costs. Data sharing and exchange via a standard API integration minimizes (or eliminates) the risks associated with human error, leading to fewer financial discrepancies and corrections.

The ability to exchange data or update ownership and transactional records rapidly across systems means that FIs can react more promptly to market changes, client requests or regulatory requirements. This enhanced agility translates into more timely (less costly) decisions and streamlined, automated back-office TA and asset management operations.

Enhanced Reconciliation and Immutability

Blockchain offers superior transparency, security, and traceability when compared to spreadsheet or centralized database approaches. When applied to TA and private asset management operations, DLT can ensure that each transaction or data modification is chronologically logged and visible to all permitted parties. This form of logging is often referred to as a time-stamped ‘state database’.

Properly designed and implemented, blockchain-enabled ledgers obviate the need for manual, time-consuming data audit processes, leading to direct cost savings. The immutable nature of DLT can reduce fraudulent activities or discrepancies which results in lower indirect costs related to dispute resolutions and compliance penalties.

DLT’s immutability reduces the time and resources dedicated to audit and compliance checks. The inherent trust and transparency in the ledger means fewer delays in transaction approvals and settlements. The transparency also ensures that all parties have a shared, accurate view of data, eliminating time-consuming, back-and-forth email or phone call communications.

The Fully Digital Transfer Agent: APIs and DLT

Integration of API-based systems with DLT creates a robust platform for transfer agency and private asset data management. FIs benefit from both the agility of API-based interconnectivity and the auditability of blockchain.

A platform combining these capabilities reduces redundancy in data management, and improves efficiency in data transfer and asset transaction/ownership verification, thereby reducing operational costs.

For FIs, implementing a system that integrates with their current infrastructure and supports real-time data updates, coupled with the trustworthiness of DLT, means that decisions are more informed, quicker, and based on a Golden Source – a single, private source of truth for all asset and transfer data.

FIs that adopt these solutions will benefit immensely in terms of cost reduction and operational efficiency, positioning themselves firmly ahead of their competition. But the capital requirements to hire for and build such a platform internally make FIs hesitant.

Vertalo has already built this platform, and is the only solution that can provide the capabilities of a Golden Source, implemented securely within an institution’s own secure cloud infrastructure.

Vertalo built its Digital Transfer Agent and Shared Ledger platform as a cost-effective solution for FIs to implement and deploy within the FI’s cloud architecture, providing the needed capabilities while protecting proprietary data privacy.

Vertalo’s Digital Transfer Agent

Vertalo’s APIs, database, and Vertalo Securities Protocol (“VSP”) provide FIs with the tools and capabilities for fully digital systems interoperability, efficient and automated data management, tokenization, and compliance for TA and private asset management operations, while satisfying the strict data privacy policies that FIs operate under.

By adopting Vertalo’s Digital Transfer Agent, FIs should expect:

Reduction in OpEx: Reduced need for manual intervention leads to a decrease in operational costs.

Improved Client Experience: Faster and more accurate services lead to improved client satisfaction.

Speed and Scalability: Automated data management leads to scalable volumes of transactions without a proportional rise in operational complexity.

Digital Transfer Agent Functionality

The Transfer Agent Role

The TA role within the platform offers FIs several advantages within back-office TA and asset management operations.

Staged Transfers via API

API-Based Custom Reports

Power of Automation

Ease of Review and Execution

Staged Transfers via API

Instead of manually inputting and processing transfers in individual or bulk transactions, Vertalo’s Digital Transfer Agent platform allows for transfers to be “staged”, meaning injected into the system for compliance review and execution, automatically via API by third parties such as issuers, brokers, custodians, etc. Automated staged transfers can offer more control over the transfer process, efficient operations, better tracking, and the potential for more secure transactions. The use of Vertalo’s APIs can further automate this process, making it easy to integrate with other systems and platforms used by third parties, without the manual intervention of extracting data, securely sending files, and injecting the data once again into the TA’s system.

API-Based Custom Reports

Vertalo provides tools to generate reports customized according to the needs of FIs through the use of GraphQL APIs rather than the limited REST APIs of legacy systems. REST’s architecture and approach is appropriate for APIs exchanging simple data sets due to ease of use, but is prone to over fetching data and lacks precision for complex data sets. GraphQL is a query language designed for precise data fetching and handling, which enables precision and accuracy of data sharing. Custom reporting can assist in understanding data better, deriving actionable insights and making more informed decisions. This customization can lead to better decision-making processes and improved results.

Power of Automation

Automation, in this context, refers to the capability of performing tasks with minimal to no human intervention after the initial setup. Automation results in faster transactions, fewer manual errors, and a more streamlined experience overall. For FIs handling vast amounts of data and transactions this is a game-changer.

Ease of Review and Execution

The design of the platform promotes straightforward review processes and easy execution of tasks. Simplified review and audit processes significantly reduce time spent on verification and validation. Easy execution ensures that tasks and processes are completed swiftly and without undue difficulty.

Regulatory and Compliance Support

Regulatory compliance remains paramount for ensuring market stability and fostering investor trust. Central to this compliance infrastructure is the implementation of rules adopted pursuant to Section 17A and 17(f) of the Exchange Act, which dictates the key responsibilities and roles of TAs, especially concerning recordkeeping, safeguarding of funds, and prompt processing of transfers. Vertalo meticulously designed its Digital Transfer Agent platform to map directly to crucial TA and other securities regulations.

Vertalo’s Digital Transfer Agent incorporates advanced recordkeeping capabilities, serving as a comprehensive ledger for (tokenized or non-tokenized) securities transactions (or any asset transactions). With an emphasis on accuracy, traceability and security, Vertalo generates and makes available an immutable audit trail, ensuring that compliance requirements set forth under SEC Rule 17Ad under the Exchange Act are consistently met. Furthermore, the Vertalo Securities Protocol implements a Controller Function, that ensures that tokenized assets also uphold key elements of securities regulations.

Vertalo’s enterprise-grade solution combines both innovative technology and a deep understanding of regulatory nuances, positioning it as the leader in harmonizing Digitized and Tokenized Capital Markets with established securities regulations.

Service Models

Vertalo’s innovative approach to transfer agency and asset management will revolutionize the financial services industry through the flexibility and capabilities of its Digital Transfer Agent. Recognizing the diverse needs of FIs, Vertalo offers three distinct service models, ensuring flexibility and adaptability in today’s security-conscious environment.

Vertalo TA

When acting as the TA of record, Vertalo takes on the full responsibility for overseeing the entire record-keeping process of securities ownership, changes, and transfers. This model provides FIs with the assurance that a dedicated entity is managing the intricate details, while they focus on their core competencies.

Sub-TA

When acting as a Sub-TA (aka, Transfer Agent Service Company), Vertalo supports an FI’s existing TA of record, operating under the existing license of the primary Transfer Agent. In the Sub-TA role, Vertalo offers a layer of specialized services, expertise, and technology to complement and enhance existing back-office TA and asset management operations. This partnership with the TA of record ensures seamless operations while tapping into Vertalo’s technological advantages (APIs and VSP).

TA Platform

For FIs seeking to harness Vertalo’s cutting-edge technology without a full suite of managed services (such as the Vertalo TA and Sub-TA services models), the TA Platform Model is ideal. FIs license and integrate Vertalo’s full technology stack into their own systems, thereby enabling a robust digital asset data management, streamlined TA operations and efficient (and reliable) data handling across relevant departments and divisions. The TA Platform Model is well suited for larger, security-conscious enterprises because Vertalo only acts as the Transfer Agent Technology Provider, allowing enterprises to manage their own operations and data while leveraging Vertalo’s APIs and VSP tokenization. The enterprise has the full capability of a Shared Ledger and a true Golden Source for TA and asset management operations fully integrated with their other systems and living inside their security perimeter.

Deployment Models

Vertalo supports three different cloud deployment models to satisfy client use cases. The Vertalo Cloud model uses a shared, Vertalo-hosted platform. The Enterprise Cloud model provides a dedicated, Vertalo-hosted platform. The Client Cloud model is a dedicated platform deployed within the client’s own cloud account. A client may use one or more of these models in parallel, e.g. Enterprise Cloud for sandbox and Client Cloud for production. Read more about these deployment models in “The Vertalo API Standard.”

Under any of these deployment models, FIs benefit from the unparalleled adaptability of Vertalo’s Digital Transfer Agent. Vertalo’s Digital Transfer Agent reduces redundancy and operational complexity, and also introduces advanced tools for systems interoperability. Furthermore, Vertalo’s emphasis on efficient data management, asset tokenization, and rigorous compliance protocols equips FIs to navigate the evolving landscape of TA and asset management back-office operations with confidence and precision.

Vertalo Database: Transfer Agent Ledger and Data Segmentation

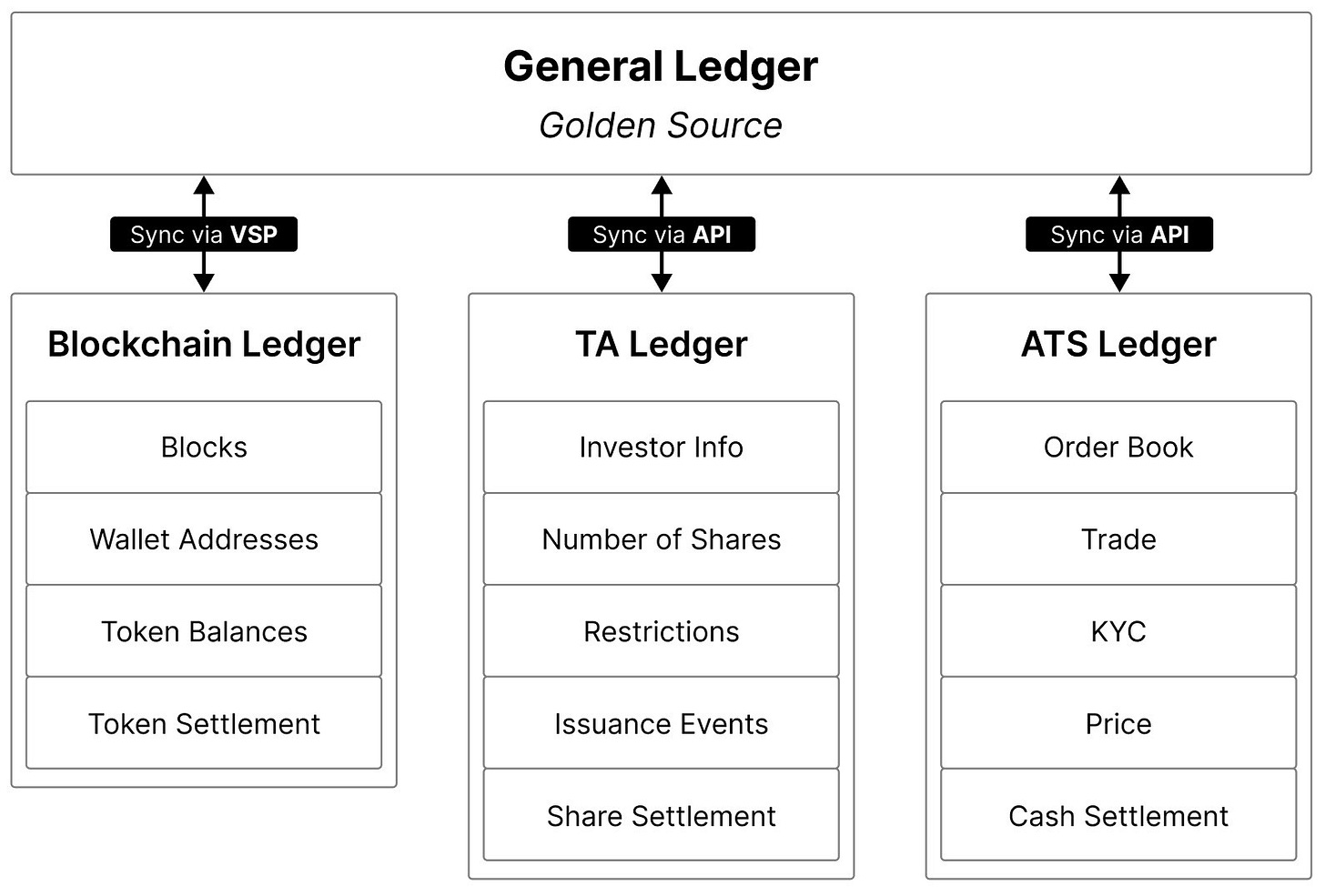

Properly categorizing and managing data is essential in ensuring the efficiency, clarity, and integrity of information within any Shared Ledger or database. Vertalo’s approach to data management segments data into purpose-built ledgers tailored to the specific data they handle: General Ledger (Golden Source), Blockchain Ledger, Alternative Trading Systems (ATS) Ledger, and TA Ledger.

Segmenting the data into purpose-built ledgers structures each data type in alignment with its unique requirements. Segmenting data into purpose-built ledgers increases efficiency, aids in maintaining data clarity and integrity, and simplifies maintenance of comprehensive data history. Data retrieval, auditing, and management become more straightforward when each ledger is optimized for its specific data type. This approach also facilitates separation of concerns, reduces the possibility of data contamination and leaks by cleanly segregating distinct data types with different access criteria.

Transfer Agent (TA) Ledger: Specifically for TA data.

ATS Ledger: Tailored for ATS data.

Blockchain Ledger: Blockchain specific data.

General Ledger (“Golden Source”) : A comprehensive ledger, syncing data with all other ledgers and capturing a broad history of data.

Transfer Agent Ledger

The data types associated with the TA Ledger support back-office TA and asset management operations.

Investor Information

Personal and financial data relating to the individual or institution investing. This includes names, addresses, tax identification numbers and more.

Number of Shares

The quantity of shares held by an investor.

Restrictions

Any restrictions placed on the sale or transfer of shares, potentially due to regulatory constraints, company policies, or investor agreements.

Issuance Events

Events where shares and other assets are issued to investors.

Share Settlement

Events that finalize the transfer of shares and the issuance of shares to the buyer.

Benefits of TA Ledger and Data Segmentation

Enhanced Efficiency

Organizing data into its distinct types and storing them in purpose-built ledgers supports quicker data retrieval and processing, optimizing back-office operations.

Improved Data Integrity

Properly-segmented data is less prone to errors, misinterpretations, or potential overlaps, ensuring a higher level of data accuracy.

Optimized Private Asset Management

Clear structure and categorization simplify the asset management process by ensuring that all necessary data points are readily available for effective decision-making and operational tasks.

Enhanced Security

Segmenting data by access type simplifies creation and maintenance of security protocols. Separating data accessible to different users makes it easy to apply use-specific controls to the data.

FI Use Case: The Golden Source

In an era where digital transformation is dominating boardroom and conference panel conversations, Vertalo gives FIs a cost-effective means to increase their speed to market through the innovative solutions of Vertalo’s Digital Transfer Agent. Vertalo’s platform is a differentiated solution tailored for the burgeoning (but massive) private asset market, offering advanced tools for TAs, tokenization, API development/standards, and private asset data management. By licensing and embedding Vertalo within their cloud infrastructure, FIs can expedite market growth and speed to market, and also orchestrate a more cohesive and interconnected private asset ecosystem. In doing so, they position themselves at the vanguard of market standards, demonstrating leadership and vision in an ever-changing landscape.

The unique proposition of Vertalo’s Digital Transfer Agent and Shared Ledger platform lies in its focus on integration, reliability, and privacy. Through these capabilities, the platform ensures that data integrity and security remain uncompromised.

Moreover, the Shared Ledger acts as a Golden Source - a singular, authoritative repository of private asset data. Whether employed within a single FI or across an extensive network of such entities, the ability to consolidate, access, and share a trustworthy source of data streamlines processes and mitigates potential discrepancies. As a result, FIs confidently navigate the complexities of the private asset realm, harnessing the full potential of tokenization and digitization, as well as ensuring unparalleled transparency and reliability for stakeholders.

Supporting Material

Butcher, Sarah. “‘Most Banks Have Systems Written in COBOL, RPG, Assembler.’” eFinancialCareers, 24 May 2021, www.efinancialcareers.com/news/2021/05/cobol-jobs-banks.

“Cost and Growth in Asset Management” PwC, Dec. 2022, https://www.strategyand.pwc.com/de/en/industries/financial-services/asset-management-2022/strategyand-asset-management-study2022.pdf

Gillis, Alexander S. “What Is Rest Api (Restful API)?” App Architecture, TechTarget, 22 Sept. 2020, https://www.techtarget.com/searchapparchitecture/definition/RESTful-API#:~:text=A%20RESful%20API%20%2D%2D%20also,preferred%20over%20other%20similar%20technologies

Hendrick, Kyle. The Vertalo API Standard. Vertalo, Inc., Aug. 2023, https://docsend.com/view/s/i2it4f7cvqg9ridy. Accessed 5 Oct. 2023.

Hsiang, Jerry. Transfer Agency and It’s Role in Digital, Tokenized and Fractionalized Securities, 21 Feb. 2022, Accessed 5 Oct. 2023.

I&TS, RBC. “The Changing Face of a Transfer Agent - RBC I&TS.” RBCITS.Com, www.rbcits.com/assets/rbcits/docs/ASTimes_issue_244_TA%20%28002%29.pdf. Accessed 5 Oct. 2023.

“Private Asset Investing Desperately Needs New Market Infrastructure.” Bain, 2 Aug. 2023, www.bain.com/insights/private-asset-investing-desperately-needs-new-market-infrastructure.

Richman, Blake, et al. “Vertalo Securities Protocol.” Docsend.Com, Vertalo, Inc., Aug. 2023, https://docsend.com/view/s/i2it4f7cvqg9ridy. Accessed 5 Oct. 2023.

Sarnowski, Tomasz. “Solve Common Legacy Systems Integration Problems .” Solve Common Legacy Systems Integration Problems , Unity Group, 5 Apr. 2023, www.unitygroup.com/blog/how-to-solve-common-legacy-systems-integration-problems/

“Saving a bundle on banks’ data costs” PwC, 2019, https://www.strategyand.pwc.com/de/en/industries/financial-services/saving-a-bundle-on-banks-data-costs/saving-a-bundle-on-banks-data-costs.pdf

Shubhnoor Gill, et al. “HTTP API VS REST API: 3 Critical Differentiators.” Hevo, 25 Aug. 2023, hevodata.com/learn/http-api-vs-rest-api/#:~:text=The%20majority%20of%20HTTP%20APIs,and%20state%20in%20REST%20applications.

Solomon Eseme “Graphql vs Rest: Everything You Need to Know.” Kinsta®, 31 July 2023, kinsta.com/blog/graphql-vs-rest/#what-is-restful-api.